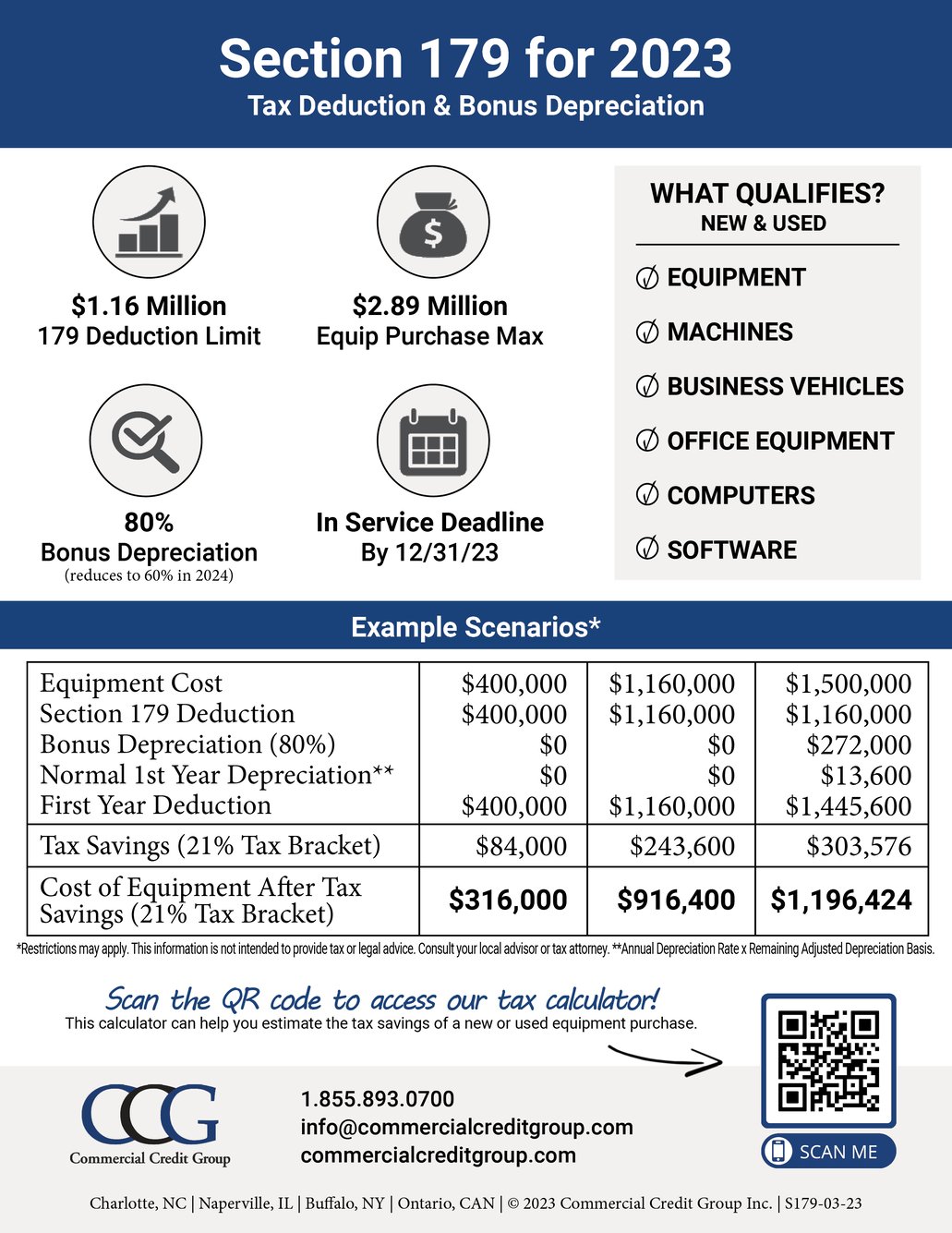

Section 179 For 2025

Section 179 For 2025. For 2025, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2025). The 2025 section 179 deduction is $1,220,000, which is $60k higher than it was in 2025.

Understanding the basics of section 179 deduction in 2025. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year. The 2025 section 179 deduction is $1,220,000, which is $60k higher than it was in 2025.

Lower your operating costs with Section 179 Equipment Source Inc., Understanding the section 179 deduction according to irs guidelines. It essentially allows businesses to.

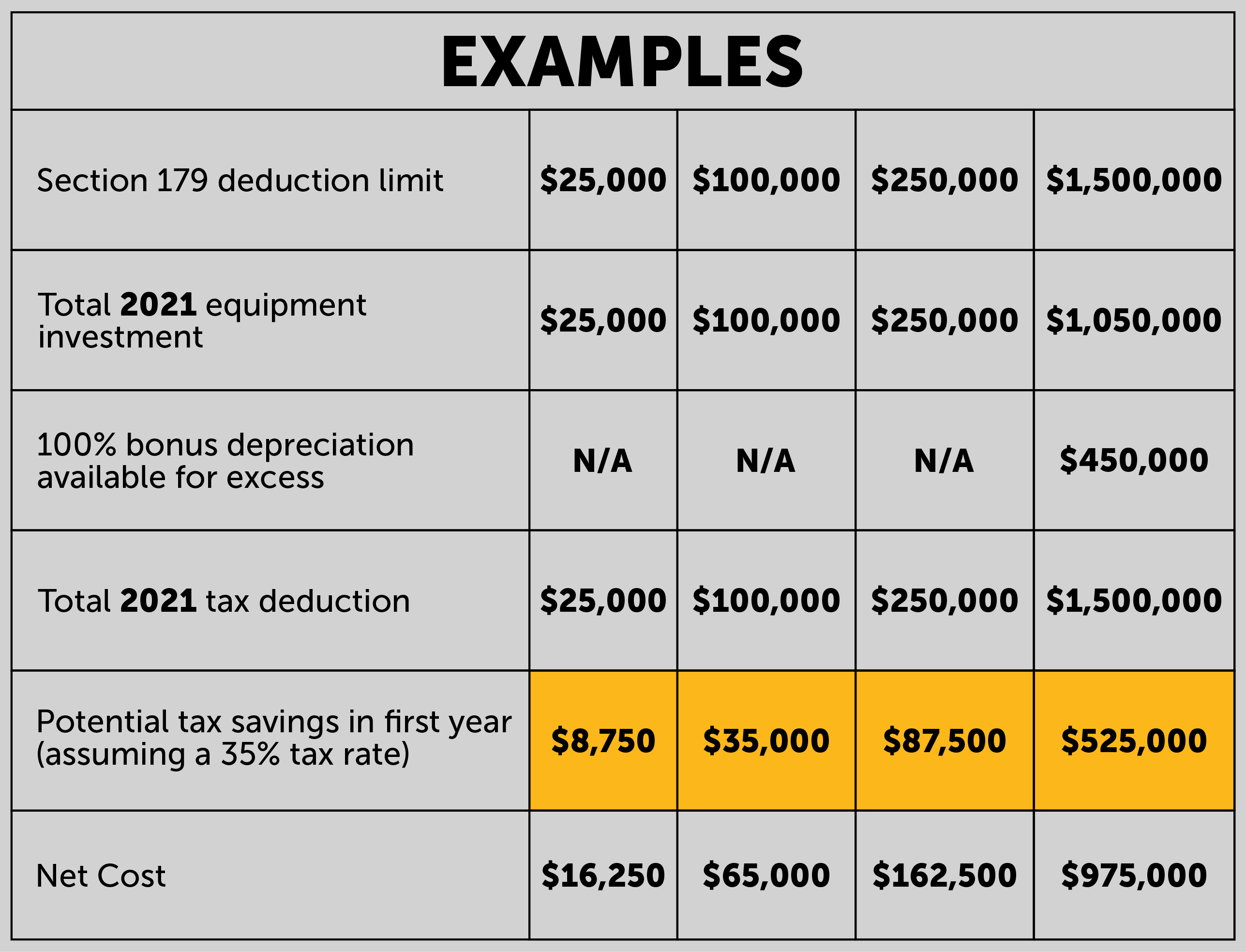

Section 179 Property Guide for 2025 Balboa Capital, The maximum deduction for 2025 (taxes filed in 2025) is $1,050,000. This bipartisan tax package proposes targeted tax relief for businesses and individuals.

How Can Section 179 Save You Money? HyBrid Lifts, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),. This deduction allows businesses to write off the entire cost of.

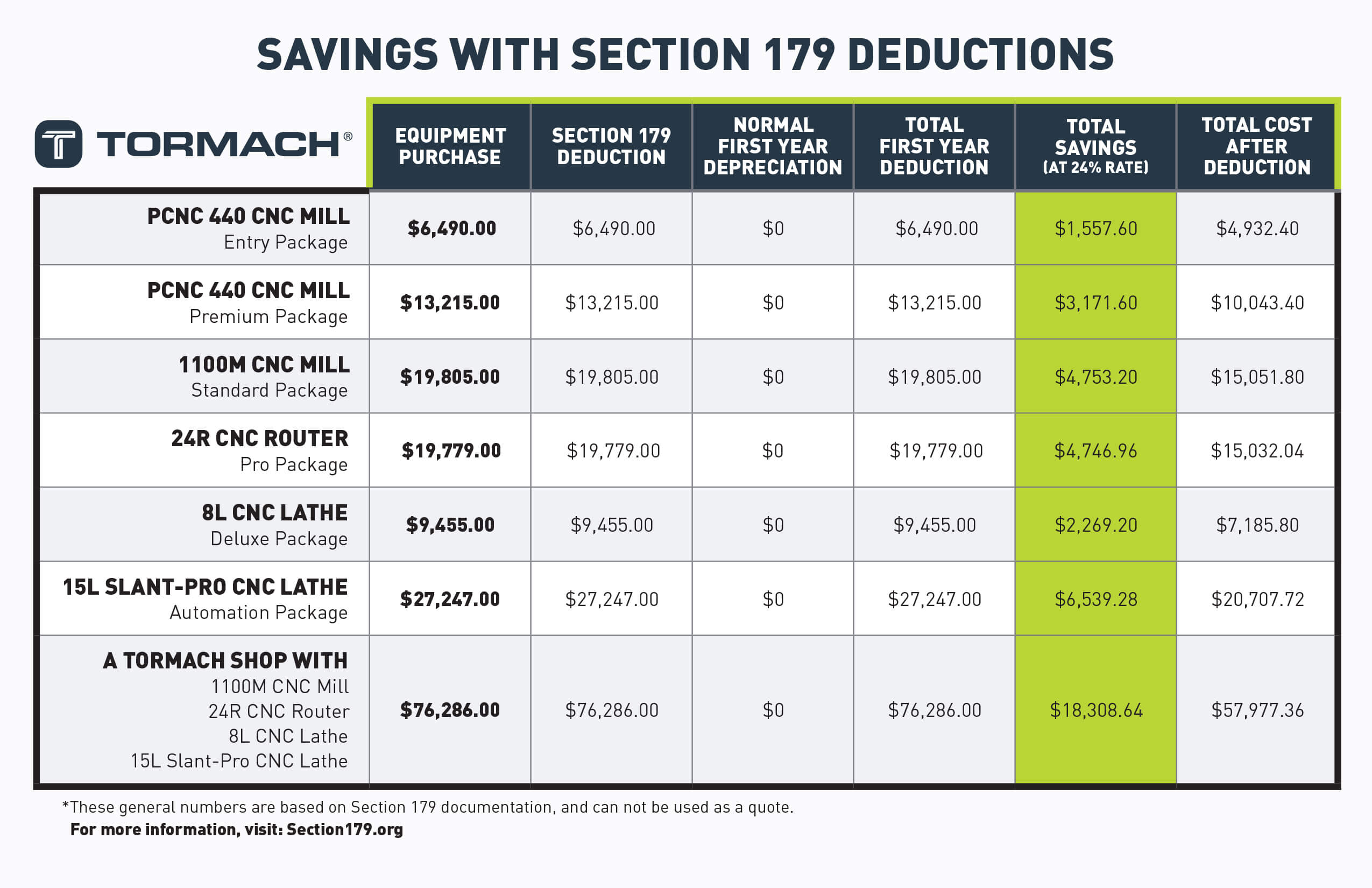

Section 179 Makes Tormach Machines Even More Affordable, It essentially allows businesses to. The section 179 deduction is a tax deduction in the united states, designed to incentivize businesses to invest in their growth and development.

8+ Section 179 Deduction Vehicle List 2025 Everything You Need To, In 2025, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2025). This tax benefit aims to stimulate investment in business assets and reduce the burden of depreciation costs.

Use Section 179 Deduction to Save on Manufacturing Software Excellerant, Understanding the section 179 deduction according to irs guidelines. What is changing in 2025?

Section 179 Deduction 2025 2025, Understanding the basics of section 179 deduction in 2025. There also needs to be sufficient.

Section 179 Deduction Vehicle VEHICLE UOI, For 2025, the maximum section 179 deduction is $1,220,000 ($1,160,000 for 2025). All businesses that purchase, finance, and/or lease new or used business equipment during tax year 2025 should qualify for the section 179 deduction (assuming they spend less.

Section 179 Tax Deduction, The 2025 section 179 deduction is $1,220,000, which is $60k higher than it was in 2025. What is changing in 2025?

Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),.