La County Property Tax Increase 2025

La County Property Tax Increase 2025. County also lobbied for ab 1607, a measure that enables even more tax increases,. Property values for most los angeles county owners increased for a 13th straight year with a 5.91% bump to the 2025 assessment roll, bringing the total value to nearly $2 trillion, the county.

Property sales in los angeles county are solely responsible for this sharp increase in the assessment roll. La county property valued at 1.89 trillion for 2025.

The 6% annual increase is greater than the rate of 2025, when the property tax assessment roll grew 3.7% to $1.76 trillion from the prior year.

Unsecured Property Tax Los Angeles County Property Tax Portal, Gross assessed values rose 16 percent. Owners sold 4,874 homes in june, nearly 21 percent fewer than this time last year.

How To Check Property Tax Informationwave17, Substitute secured property tax bill a replacement bill used for making property tax payments on lost or missing original bills. The 6% annual increase is greater than the rate of 2025, when the property tax assessment roll grew 3.7% to $1.76 trillion from the prior year.

Unsecured Property Tax Los Angeles County Property Tax Portal, Gross assessed values rose 16 percent. The county also raises money locally from property and sales taxes and by providing services to cities or agencies that reimburse the county’s costs.

La County Property Tax Bill History ZDOLLZ, A strong real estate market and new construction lifted los angeles county property assessments to a record $1.6 trillion in this tax year, the ninth straight. Officials introduced lancaster county’s proposed 2025 budget this week, the 11th in a row that does not raise property tax rates.

How to read your property tax bill LA COUNTY Property tax, Los, Property values for most los angeles county owners increased for a 13th straight year with a 5.91% bump to the 2025 assessment roll, bringing the total value to nearly $2 trillion, the county. County assessors captured those higher values in their 2025 assessments.

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal, It does, however, use about $3.4 million from its. Annual property taxes may be adjusted during the.

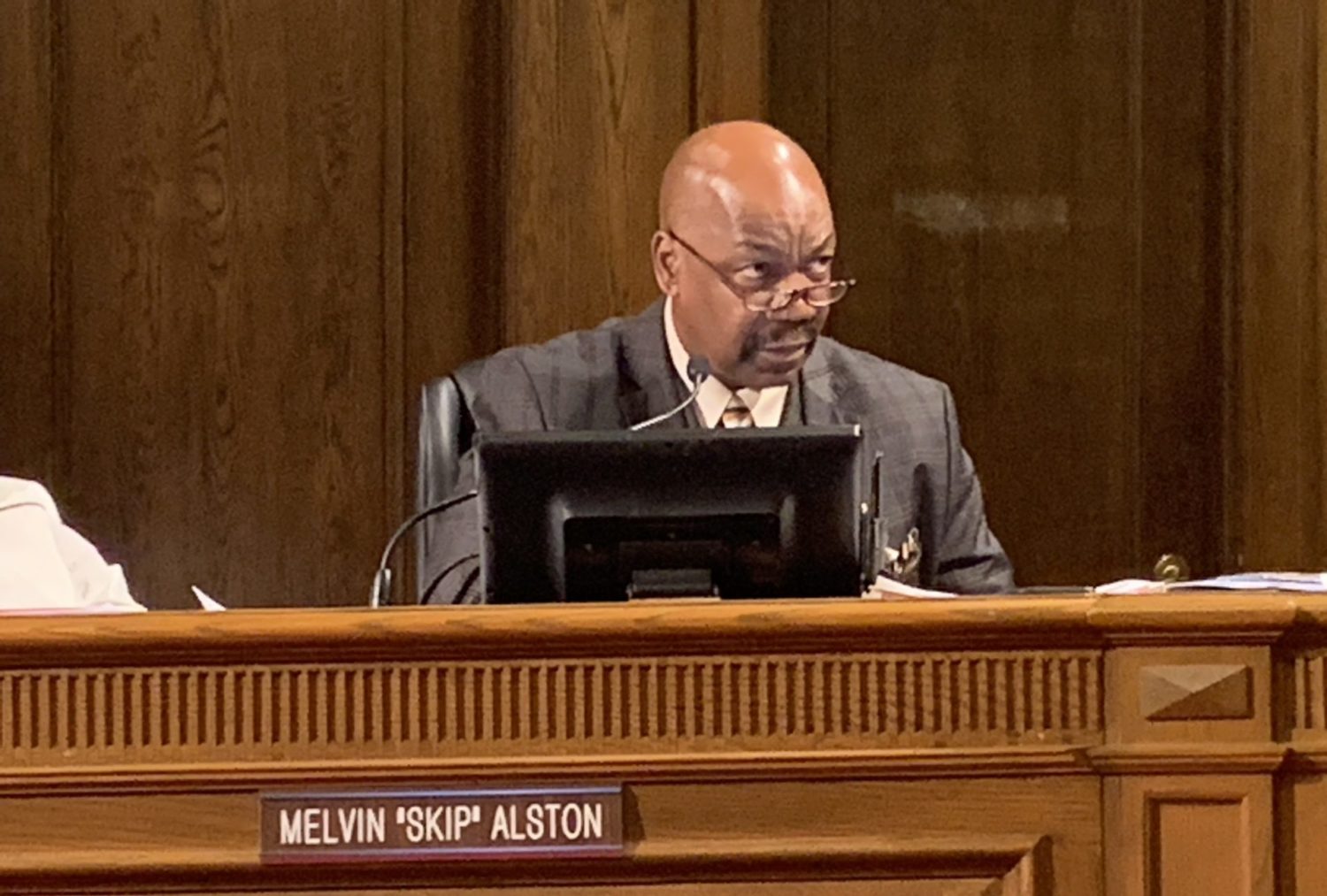

Wayne County property tax increase Final vote delayed a week, County assessors captured those higher values in their 2025 assessments. The 6% annual increase is greater than the rate of 2025, when the property tax assessment roll grew 3.7% to $1.76 trillion from the prior year.

10 Controllable and Uncontrollable Factors In Property Tax Increase, Substitute secured property tax bill a replacement bill used for making property tax payments on lost or missing original bills. The median property tax in.

Expect No County Property Tax Increase For The Next Four Years The, Officials introduced lancaster county’s proposed 2025 budget this week, the 11th in a row that does not raise property tax rates. A strong real estate market and new construction lifted los angeles county property assessments to a record $1.6 trillion in this tax year, the ninth straight.

La County Property Tax How Much Do I Owe Property Walls, Those values were used for tax. County assessors captured those higher values in their 2025 assessments.

Officials introduced lancaster county’s proposed 2025 budget this week, the 11th in a row that does not raise property tax rates.