Current Fica Tax Rate 2025

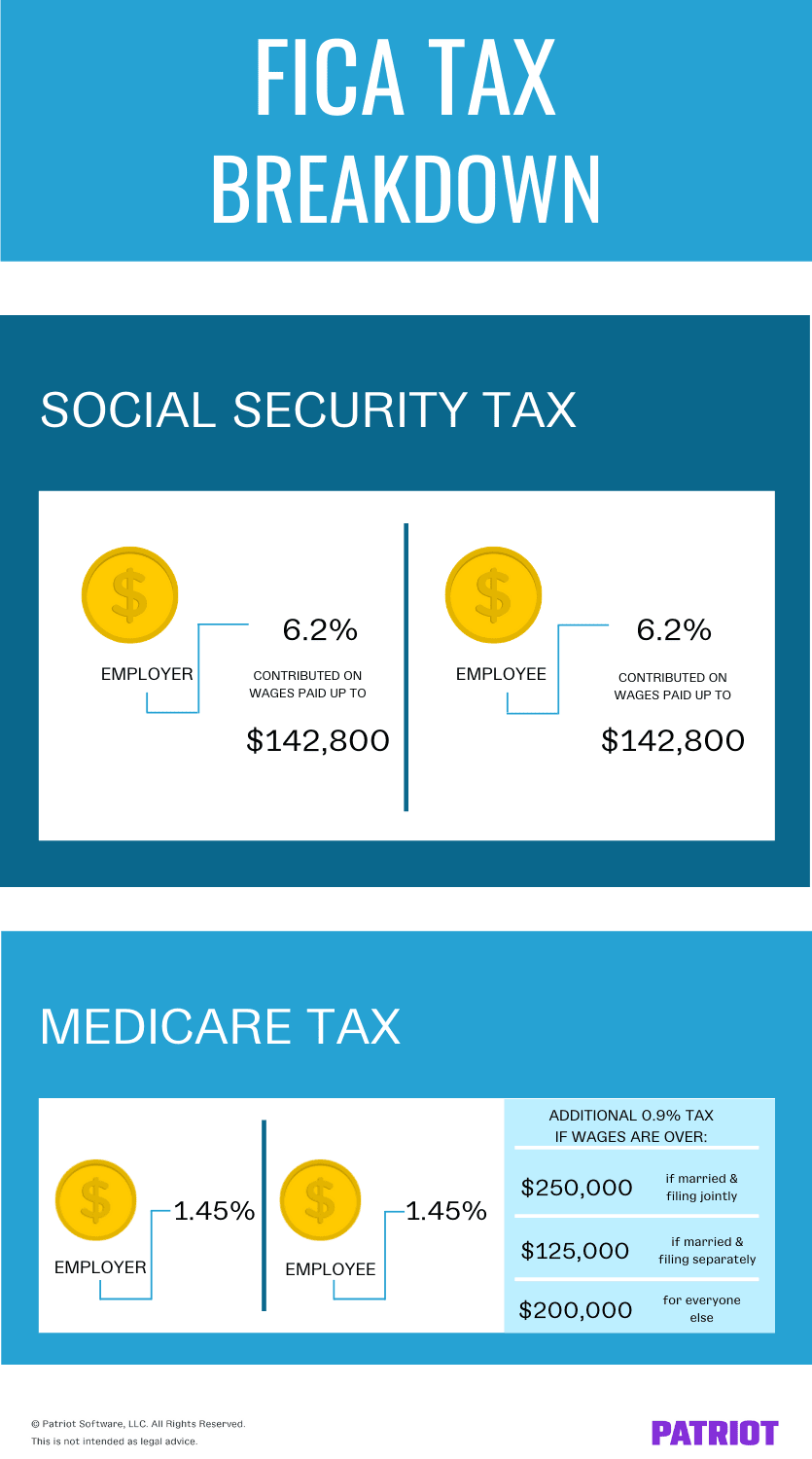

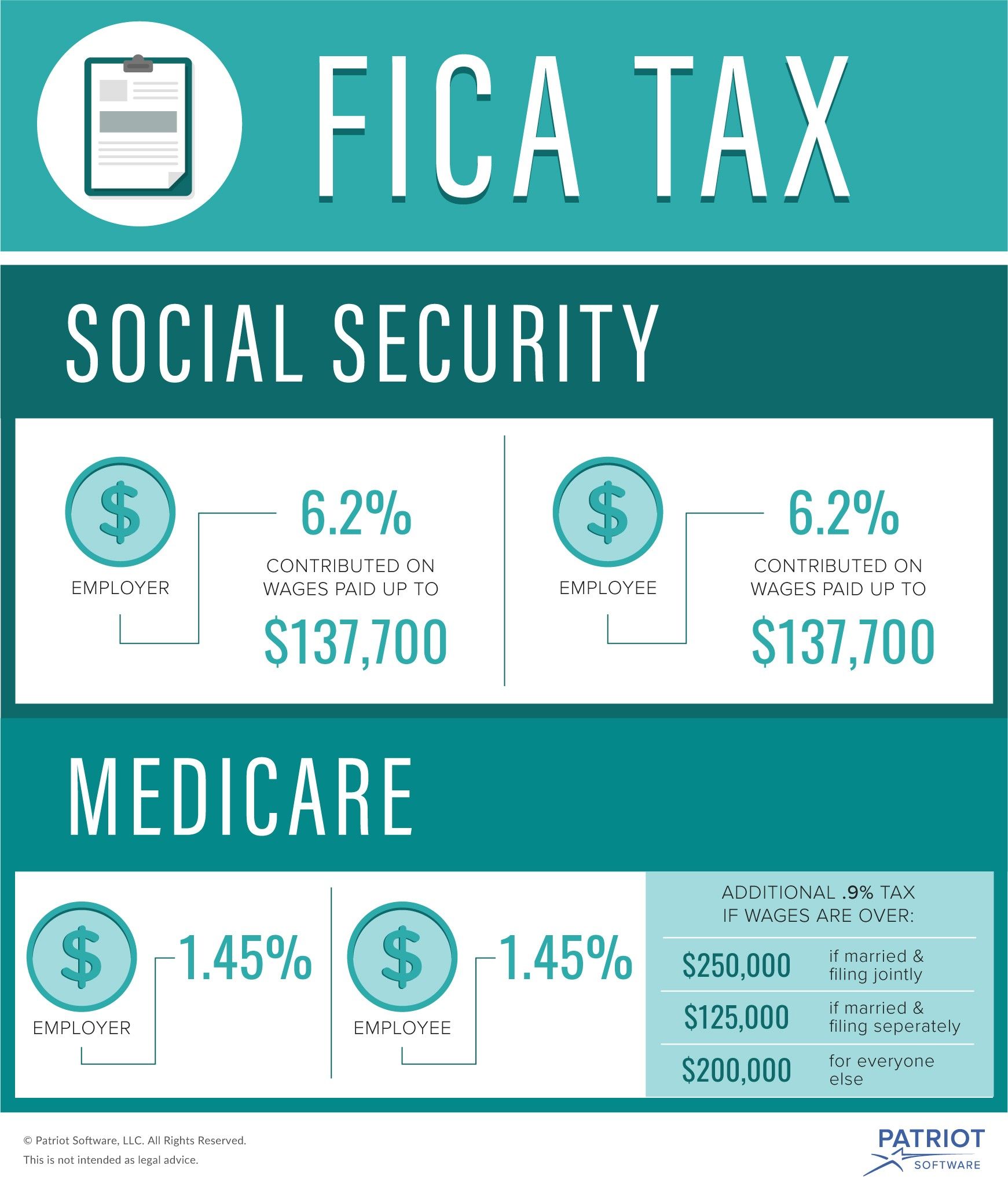

Current Fica Tax Rate 2025. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Tax rates for each social security trust fund.

FICA Tax Rate 2025, Various factors determine this rate, and this article will cover them. For 2025, the irs has set the fica limit at $160,200.

Fica And Medicare Tax Rates 2025 Adara, 6.2% for both the employer and the employee. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

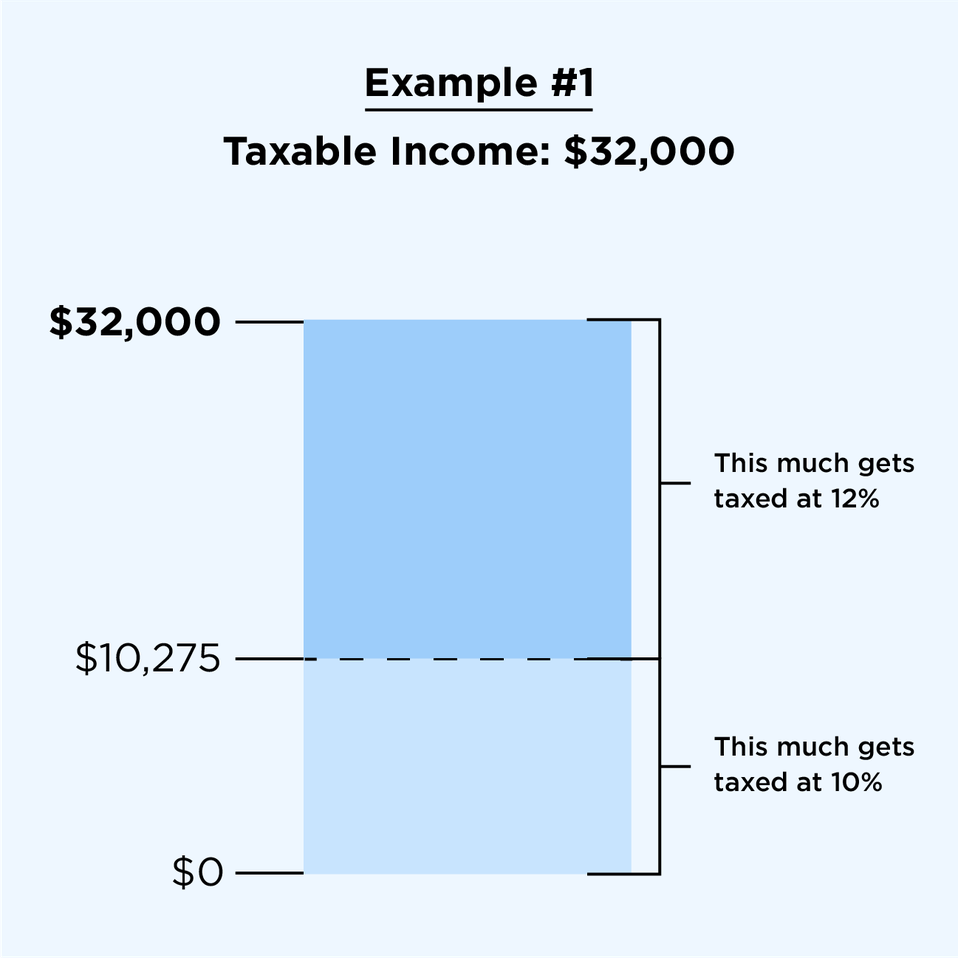

2025 Tax Brackets Irs Chart Vivia Linnie, Enter your income and location to estimate your tax burden. Tax rates for each social security trust fund.

Fica And Medicare Tax Rates 2025 Adara, Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. The fica tax rate is based on current laws and regulations, which determine the percentages for social security and medicare taxes.

How Much Is Fica 2025 Abbey, Get the full rundown on fica taxes. For 2025, the irs has set the fica limit at $160,200.

Federal Tax Rate 2025 Edyth Ottilie, 6.2% for both the employer and the employee. The fica rate for 2025 remains unchanged at 7.65% for employers and 7.65% for employees.

Tax rates for the 2025 year of assessment Just One Lap, What is the fica rate for 2025? Payroll tax rates include several parts, but at the federal level, employers must pay taxes under the federal insurance contributions.

2025 Max Fica Tax Erna Odette, You can calculate your fica taxes by multiplying your gross wages by the current social security and medicare tax rates. The fica tax rate is based on current laws and regulations, which determine the percentages for social security and medicare taxes.

What Is The Employer Fica Rate For 2025 Denna Tamarra, Social security and medicare tax for 2025. Social security wage base limit for 2025:

/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

Learn About FICA, Social Security, and Medicare Taxes, We make it easy to understand medicare and social security taxes, current fica tax rates, and more. Social security tax must be withheld at 6.2% until employees’ wages reach this limit.

/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Mclaren 2025 Bahrain Airport. Get ready to go racing with our guide to the 2025 bahrain grand prix! Hear from mclaren formula 1 drivers lando norris and oscar piastri, as

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Foe Spring 2025 Event. 400% attack for attacking army. Prepare for a groundbreaking adventure with care for tomorrow 2025! 3 contribute 20fp to gb. My name is mooingcat and welcome

Daytime Emmy Awards Nominations 2025. The nominees for the 51st annual daytime emmy awards are here with certified national treasure dick van dyke becoming the oldest nominee in the awards'